In the vibrant and rapidly evolving region of South America, personal insurance—encompassing life, health, and personal accident coverage—serves as a vital safety net for individuals and families. As economies grow, middle classes expand, and awareness of risks increases, the demand for these protections has surged. By late 2025, the broader Latin American insurance market has reached impressive heights, with personal lines playing a pivotal role in this expansion. This comprehensive article delves into the landscape of personal insurance across South America, examining market trends, key product types, major providers, penetration, rates, challenges, and future outlook. For residents, expats, and travelers alike, understanding these options is key to securing financial stability amid life’s uncertainties.

Market Overview and Growth Trends

The personal insurance sector in South America has demonstrated remarkable resilience and growth in recent years. As of mid-2025, the total Latin American insurance market is projected at around USD 181.7 billion in net written premiums, with significant contributions from personal lines such as life and health. The region has emerged as one of the fastest-growing insurance markets globally, with gross written premiums expanding at an average annual rate of 11% from 2019 to 2024.

Life insurance has been a standout performer, driven by rising interest in savings products and annuities amid favorable interest rate environments. Health insurance, meanwhile, continues to expand due to increasing demand for private coverage to supplement often overburdened public systems. Personal accident insurance, though smaller, is gaining traction with growth rates around 8-9% in non-life segments.

Country variations are notable: Brazil dominates with the largest premium volumes in life insurance, followed by Mexico and Chile. Overall, the market grew 7.5% year-over-year in USD terms as of June 2025, with even stronger local-currency growth reflecting inflation adjustments. Projections for 2026 anticipate continued expansion at around 4% in real terms, supported by economic stabilization and digital adoption.

Digitalization is a key trend reshaping personal insurance. Online platforms and mobile apps are making policies more accessible, particularly for younger demographics. Bancassurance—insurance sold through banks—remains dominant, accounting for a substantial share of distribution, especially in life products.

Banks and the Digital Wallet Race: The Embedded Insurance Strategy …

Types of Personal Insurance

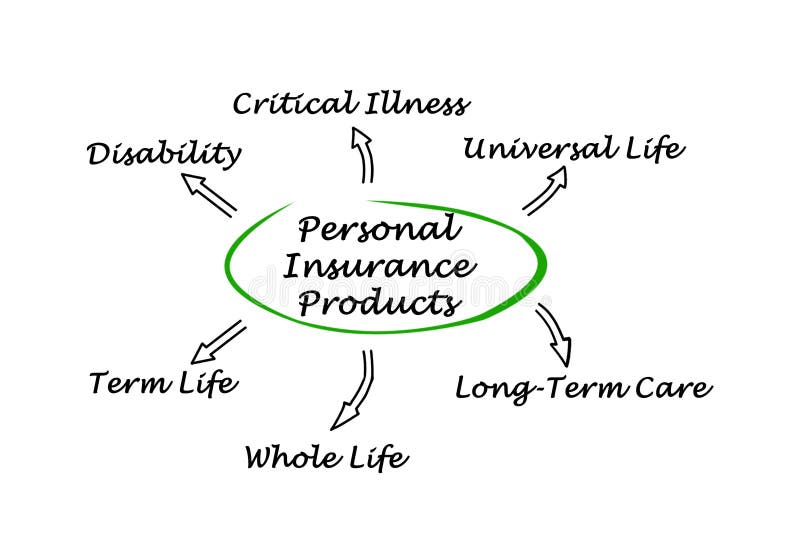

Personal insurance in South America primarily falls into three categories: life, health, and personal accident.

Life Insurance: This provides financial protection for beneficiaries in the event of the policyholder’s death. Products range from term life (pure protection) to whole life or universal life with savings components. In Latin America, savings-linked life products have thrived due to high interest rates, offering both protection and investment returns. Penetration remains low compared to developed markets, but awareness is rising with an expanding middle class.

Health Insurance: Often the most sought-after personal line, private health coverage supplements public systems, which can face long wait times and limited resources. Policies typically cover hospitalizations, outpatient care, medications, and sometimes dental or maternity. In countries like Brazil and Mexico, private plans are essential for accessing quality care quickly. The market has grown steadily, with premiums reflecting demand for comprehensive coverage amid rising healthcare costs.

Personal Accident Insurance: This covers injuries, disability, or death from accidents, often including medical expenses and income replacement. It’s popular for high-risk professions or as add-ons to other policies. Growth in this segment has been robust, around 8-9%, driven by workplace requirements and individual awareness.

Many providers bundle these, offering holistic family protection plans.

Major Providers and Competitive Landscape

The market features a blend of local powerhouses and international players. Bradesco leads in many rankings, particularly in Brazil’s life segment, followed by MAPFRE, the top multinational with extensive regional presence. Grupo SURA ranks highly for written premiums, while MetLife and Generali hold strong positions in countries like Chile and Argentina.

Other notables include Porto Seguro and Itaú in Brazil, GNP in Mexico, and Rimac in Peru. The top groups control about 64% of the market, indicating moderate fragmentation with room for competition. International firms like Zurich and Allianz also operate, often through partnerships.

Consolidation is ongoing, with mergers enhancing scale and digital capabilities.

Penetration and Accessibility

Despite growth, insurance penetration in South America lags global averages, at around 3% of GDP regionally. Puerto Rico leads at over 16%, followed by Chile at 4-5%. Density (premiums per capita) averages $300-340, varying widely by country.

Low penetration stems from economic inequality, informal employment, and limited financial literacy. However, the protection gap—the difference between needed and actual coverage—is estimated at hundreds of billions, presenting huge opportunities. Initiatives to educate consumers and simplify products are bridging this divide.

Challenges Facing the Sector

Personal insurance faces several hurdles. Economic volatility, including inflation and currency fluctuations, impacts affordability and premium values in USD terms. Public health systems’ strains push demand for private coverage but also highlight access issues in rural areas.

Underinsurance is prevalent, especially in life and accident lines. Regulatory differences across countries complicate multinational operations. Climate risks and health pandemics underscore the need for resilient products.

Digital adoption, while growing, faces barriers like uneven internet access. Trust issues and complex policy language deter uptake.

Future Outlook and Recommendations

The outlook is optimistic, with premium growth expected to outpace GDP through innovation and inclusion. Microinsurance and embedded products (e.g., via mobile wallets) will target underserved segments. AI and data analytics will personalize offerings, improving risk assessment and customer experience.

For individuals: Compare providers like MAPFRE, Bradesco, or local leaders. Assess needs—health for frequent care, life for family protection. Expats should consider international plans for broader coverage.

As South America’s economies mature, personal insurance will become indispensable, fostering greater financial security in this dynamic region.